VAT Reverse Charge for Construction and Building Services

- What is Reverse Charge VAT?

- Why is it Being Introduced?

- When Did It Come into Play?

- Who Will Be Impacted?

- Who is an ‘End User’?

- When is Reverse Charge VAT Applicable?

- Who is Responsible for What?

- Are VAT Rates the Same?

- How Do I Show VAT on Invoices?

- How Will the New Reverse Charge Rules Affect My Business?

- What Can I Do to Minimise The Impact?

If you are running a business in the construction and building sector, you are probably just getting to grips with the new set of rules on VAT. The Domestic Reverse Charge (DRC), a new way of accounting for VAT, applies to all VAT registered construction businesses in the UK.

It’s not a good idea to just leave this to your accountant or bookkeeper. It’s business-savvy that you, as a business owner, understand how the VAT rules will work. For a start, it’s likely to affect your cashflow and you’ll also need to reassess the wording in your contracts so that responsibilities for VAT are clear.

As the new rules on Reverse VAT come into play, this blog will keep you on track with everything you need to know and provide some insight into how Joblogic can help your business with these new changes.

What is Reverse Charge VAT?

Reverse VAT changes the way customers account for VAT on construction services. From 1 March, the only companies in the construction chain that will bill for the tax on their supplies will be those that have contracted with an end user or the customer of the building. It means HMRC gets its money from the contractor at the top of the chain, rather than at the bottom.

Suppliers of goods or services in construction will no longer pay VAT to HMRC. Instead, the customer charges it to themselves, rather than the supplier charging it.

Why is it Being Introduced?

The new legislation is being introduced to combat tax fraud. ‘Missing trader’ fraud, (where a supplier charges and collects VAT, but then does not pay it to HMRC), reportedly costs HMRC in excess of £100M in ‘lost’ tax revenue each year. Reverse VAT makes it the customer’s responsibility to account for VAT and cuts the supplier out of the VAT cashflow so there is no opportunity for the supplier to disappear without handing over the sum to HMRC.

When Did It Come into Play?

The new VAT rules, effective from 1st March 2021, already apply. Don’t panic if you aren’t quite getting to grips with things – HMRC is applying a ‘light touch’ for at least the first six months as businesses bed the new rules in (as long as you are attempting to comply, you’ll be fine).

Who Will Be Impacted?

The changes will impact all contractors and sub-contractors who supply construction services as per the Construction Industry Scheme (CIS). This includes:

- General construction

- Groundwork construction

- Renovations and maintenance

- HVAC

- Cleaning

There are exemptions. These include:

- New build properties with 0% VAT

- Supplies with 0% VAT

- Trading between connected companies, i.e. those with a shared ownership

- Landlord and tenant transactions incorporated within CIS

Exemptions also apply to supplies not included in the definition of construction services, such as drilling, extracting minerals, manufacturing certain building or engineering components, and some professional services and installation work – a full list of exemptions can be found here.

So far, so good.

But here’s where things get slightly more complicated – you’ll need to be clear about where your business sits in the supply chain, specifically, whether or not you are deemed an end user and when to apply the DRC. Stay with us. There’s a lot to get your head around, but it’s not overtly complex – more a case of information overload.

Who is an ‘End User’?

The ‘end user’ is a term used in reverse charge VAT law that needs to be understood. The Building Engineering Services Association (BESA) defines the ‘end user’ as:

“A business who will use the building or structure themselves in their own business either as a building to sell, or to rent out, or for their own use, e.g. as offices.”

“Development and property companies and housebuilders are end users because they will rent or sell what they have commissioned. They deal in assets rather than supply construction services.”

To establish whether you are working for an end user, you must ask yourself who you are actually contracted with – who will pay you? Is the firm that you work for the end user of that building or part of the construction activity supply chain?

When is Reverse Charge VAT Applicable?

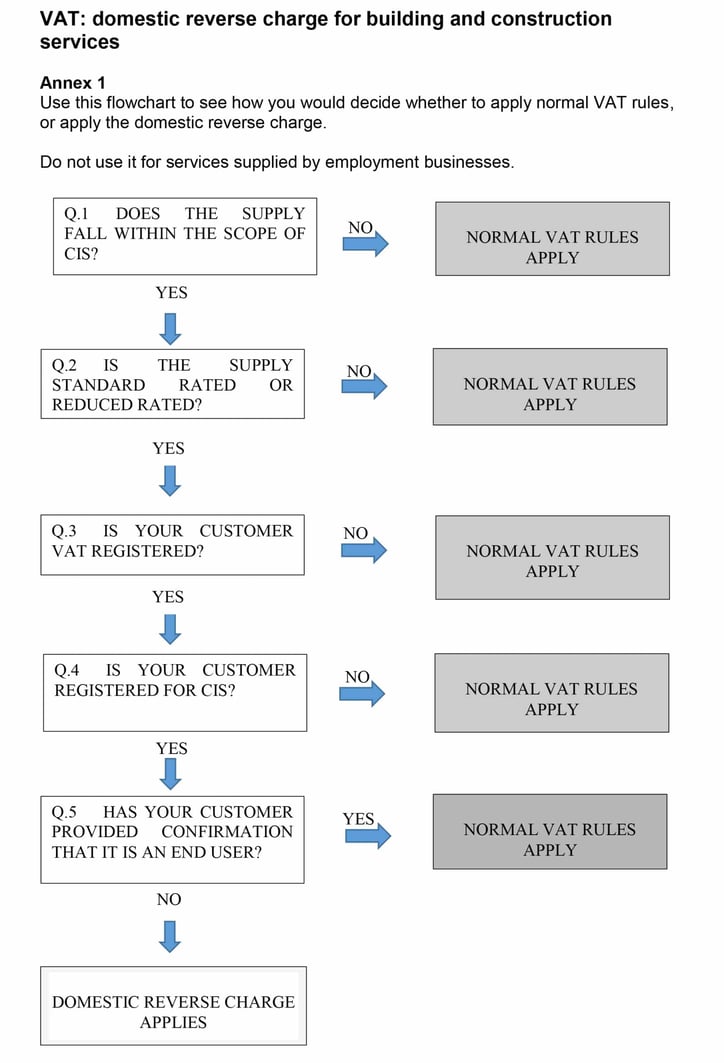

This flow diagram by HMRC will help you:

Who is Responsible for What?

If you are a CIS contractor, when you receive a bill from your CIS subcontractor, you are responsible for reporting both the input and output VAT on that bill.

If you are a CIS subcontractor you will no longer charge VAT to your CIS customers. Instead, on your invoices you need to state your customer is responsible for the VAT and show what VAT rate should be applied.

Are VAT Rates the Same?

VAT will still be applied at the appropriate rate, however, where construction services are provided to anyone other than an end user, the supplier of those services will no longer need to account for the VAT element.

How Do I Show VAT on Invoices?

Invoices must contain the VAT identification number and the value of the construction services provided. It should also include either the rate of VAT or the amount due as a Reverse Charge. Invoices also need to include a declaration regarding responsibility.

The customer of the construction services will then be responsible for, and account for, the VAT element of these services in their own VAT return.

Here’s an example from HMRC:

How Will the New Reverse Charge Rules Affect My Business?

If you are a subcontractor, it’s likely your cashflow will be negatively impacted in the short-term. If you are the contractor (Tier 1), you’ll see a short-term cashflow benefit, though VAT payments to HMRC at the end of each quarter will increase. If you are a contractor (Tier 2) working for other contractors, you will no longer receive VAT on the services you supply but instead you will be paying it to suppliers of plant and materials. This means you will move from owing VAT to HMRC each quarter to being due a VAT repayment from HMRC each quarter. This shift could have a major impact on your cash flow!

Here’s how.

Before reverse charge VAT was introduced, many suppliers used the VAT they were paid by their customers as a boost to their cashflow (working capital), funding payments to suppliers until they were required pay it to HMRC in their next VAT return. Now for some, payments received will be net of VAT. It’s not hard to see how cash-strapped businesses could suddenly find it difficult to pay suppliers. In a worst-case scenario, this sudden lack of working capital could cause a business to go under.

What Can I Do to Minimise The Impact?

First up, effective forecasting is key. Businesses should take time to consider the wider supply chain picture and plan accordingly for any reduction in cashflow. Businesses that are regularly owed money by HMRC on their VAT return can move to monthly VAT returns which will speed up any payments due. Make sure your software programs are geared up to deal with the changes. Accounting systems like Xero or Sage, for example, will handle the domestic reverse charge automatically.

Joblogic’s Field Service Management software is fully integratable with most accounting software and is also set up to accommodate Reverse VAT Charging, enabling the application of tax rates and providing relevant document templates.

Book a free demo today to see how Joblogic help your business.